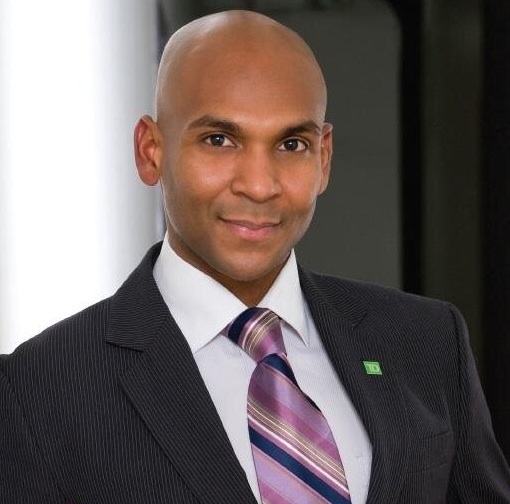

Happy Pride! June is officially Pride Month, but for Al Ramsay, National Manager, LGBTQ2+ Business Development at TD, it’s Pride 365 – which means all year long and #ForeverProud every day!

TD in the Community: #ForeverProud

GGN Publisher, Shaun Proulx, had to literally kidnap AL for the 2019 Pride Edition of #FinanciallyFit, because not only is AL participating and supporting Pride Toronto (the festival weekend happens 21-23 June), but he’s leaving on a jet plane to attend World Pride in NYC the following weekend! The #ForeverProud Team will be attending additional Pride in Kelowna, Vancouver, Montreal, Halifax, Calgary, and Ottawa. TD’s brand colour might be green, but it is pink with its sponsorship of 93 Pride Festivals and over 180 community organizations throughout the queer year!

In Toronto (where GGN is based) TD is a lead sponsor for Toronto Pride as well as the GreenSpace Festival held at the 519 Community Centre on Church St. Shaun and Al have a heart-to-heart about why Pride – in every city, no matter how big or small – is still so important and why continued financial support from TD and other sponsors is vital to our acceptance and visibility as a community.

Your 2019 Pride and Summer Budgeting

Orlando Lopez, TD Financial Planner, offers hot tips to manage your Summer Spending for your Pride travels, vacation, and other summer activities.

Let’s be honest, we all know that Pride can be expensive. You have to buy clothes, tickets to events, pay for transportation after a long day (and night out), and those “after hours costs” like parties and all the fun and imbibing that comes with it. It’s too easy when you are not at your “soberest” to hit the ATM and wreck your budget. Here’s how to manage your finances around Pride and over the summer:

- Speak to your Financial Advisor – It’s likely you’ll spend more during the Summer holidays so budget and plan according. You can leverage financial apps like TD My Spend Tools and Cash Flow Management.

- Use your credit card (instead of cash) and loyalty cards – make them work twice as hard for you by earning and using Aeroplan miles or cash-back rewards.

- Cash is also another alternative so that you stay on budget.

- Be creative – share expenses with family and friends. Organize a potluck dinner or entertain at home and at friends instead of eating out

- Staycation – enjoy outdoors parks and bring your own food or take out.

Hear all the details and helpful advice on the Pride Edition of #FinanciallyFit:

#FinanciallyFit – Money talk that’s anything but dry.

Al Ramsay has a team of financial advisors dedicated to supporting the LGBTQ2+ community. Book a meeting or connect on with Al on Twitter, @Al_ForeverProud.

Listen to past episodes of #FinanciallyFit, here on the Gay Guide Network.